The USDA’s New Farmer Bridge Assistance Program: What You Need to Know

As producers head into a challenging 2026 season marked by tight margins and continued market uncertainty, the U.S. Department of Agriculture has introduced a major support effort aimed at easing some of the financial strain. The new Farmer Bridge Assistance program is designed to help offset a portion of the projected economic losses for 2025 crop production — losses driven by volatile markets, large production and persistently high input costs.

Below is a quick breakdown of what the program includes and what farmers should expect.

Program Overview

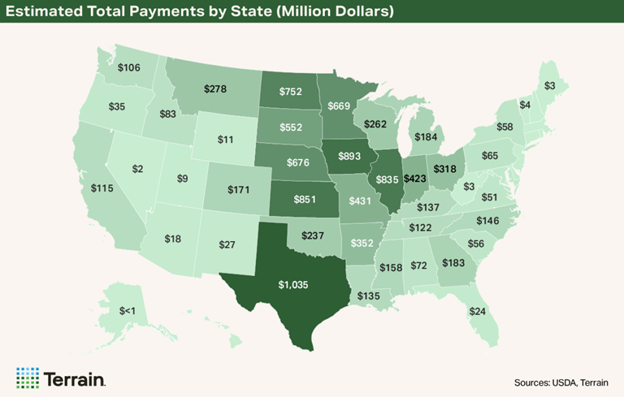

The Farmer Bridge Assistance program provides payments to producers of a wide range of row crops. The USDA has allocated $11 billion in total program funding, making it a significant resource for crop farmers navigating the current economic climate.

These payments aim to bridge the financial gap created by market disruptions and elevated production expenses, especially as producers look ahead to the 2026 crop year.

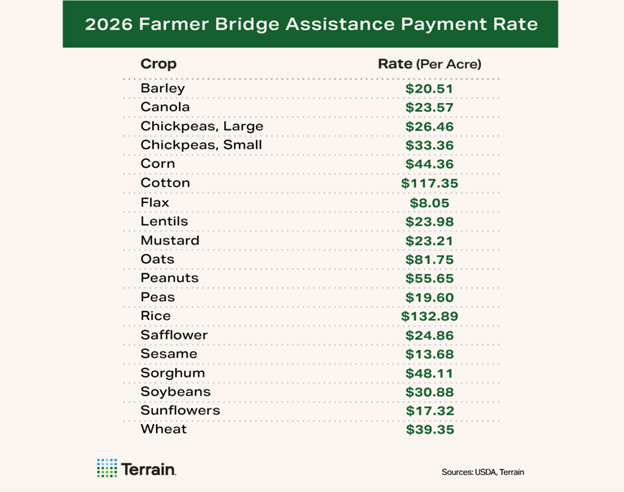

Payment Rates Across Crops

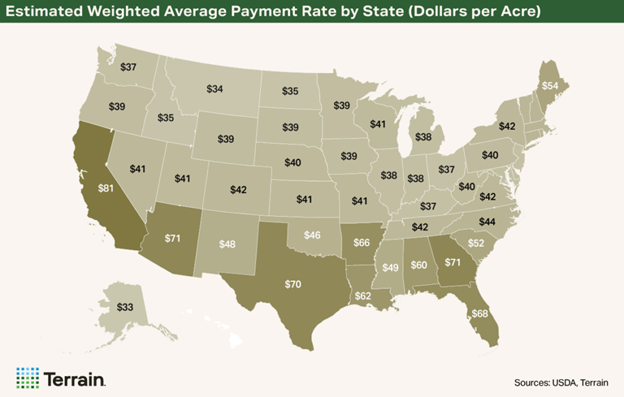

Payment rates vary significantly depending on the crop:

- Lowest payments: $8 per acre for flax.

- Highest payments: $133 per acre for rice.

- Major row crops — including corn, soybeans, wheat and sorghum — generally fall in the $30 to $50 per acre range.

These payment rates reflect differences in average projected economic exposure across commodities, allowing support to be tailored where it’s needed most.

When Payments Will Be Available

One of the most important details for farmers planning their spring operations: Payments are expected to be available by late February 2026.

This timing aligns with early-season cash needs, offering much needed liquidity ahead of planting. In a tight cash environment, these payments may help producers:

- Cover up front input costs.

- Strengthen working capital.

- Reduce the need for additional short-term financing.

What This Means for Your 2026 Season

While the program won’t erase the broader economic pressures facing agriculture, it provides meaningful relief at a pivotal moment. As planting approaches, these funds can help producers stay flexible, manage risk and maintain operational stability.

Read the full article: https://www.terrainag.com/insights/farmer-bridge-assistance-payment-rates-revealed/

About Terrain

An offering of AgCountry Farm Credit Services, American AgCredit, Farm Credit Services of America and Frontier Farm Credit, Terrain delivers exclusive insight and confident forecasting in the market areas that have impact on our customers’ businesses.